A paper credited in part to Mercari R4D researcher Kenji Kubo has been published in the International Academic Journal “Finance Research Letters.” The paper, titled “Optimal liquidation strategy for cryptocurrency marketplaces using stochastic control,” details the results of joint research between Mercari R4D, Nomura Asset Management, and Mercoin.

- Paper published by the Special Interest Group on Financial Informatics (SIG-FiN)(only available in Japanese)

- Paper published by Finance Research Letters:Optimal liquidation strategy for cryptocurrency marketplaces using stochastic control

Research Summary

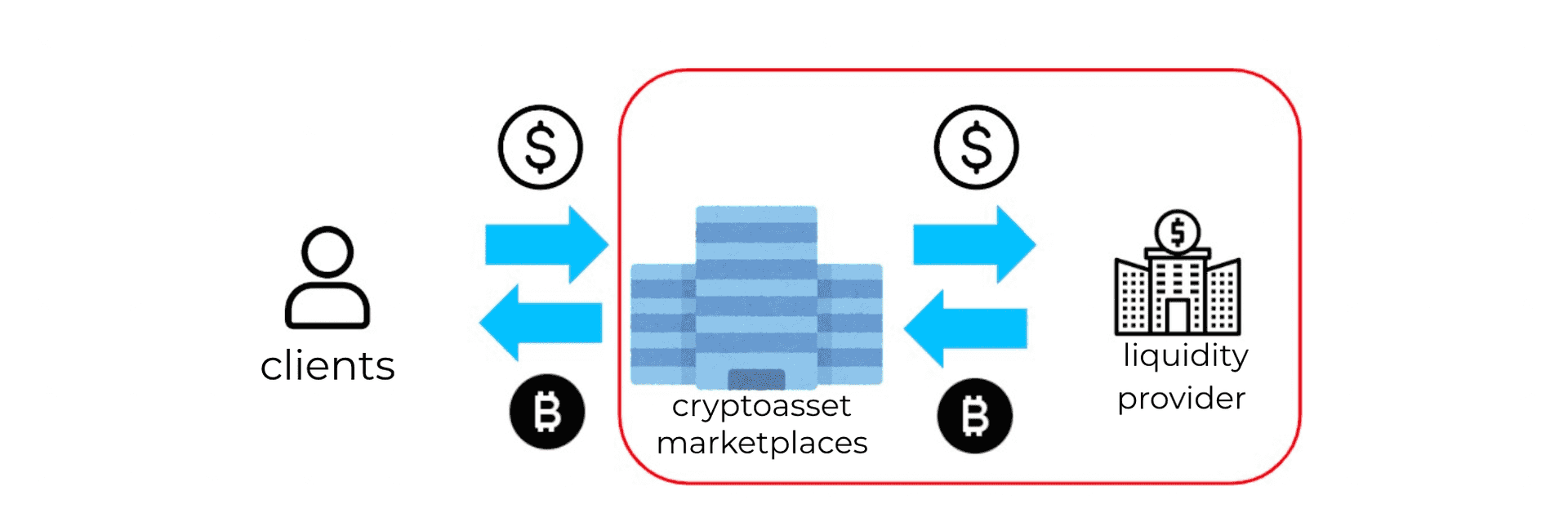

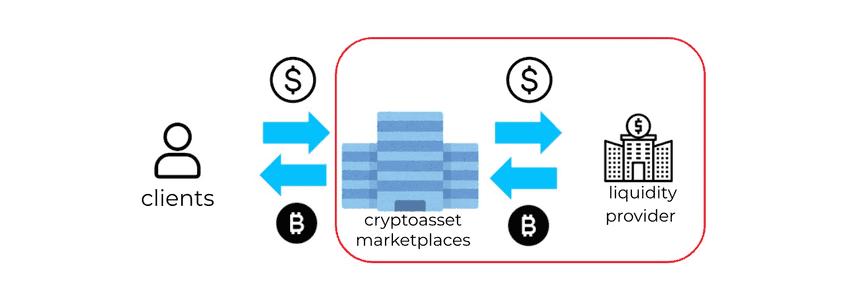

A cryptoasset marketplace is over-the-counter trading services that quotes bid-ask prices, receives cryptoasset orders from clients, and supplies liquidity to cryptoasset markets. The cryptoasset inventory of a cryptoasset marketplace varies depending on the quantities of orders received from clients; at the same time, any existing inventory is constantly exposed to the risk of price fluctuations. Therefore, it is crucial to manage cryptoasset inventory appropriately. An optimal liquidation strategy has also been proposed for the inventory management problems of FX dealers, which also handle over-the-counter transactions. However, compared to the FX market, the cryptoasset market has characteristically low liquidity and high volatility. Moreover, at cryptoasset marketplaces, there is a significant asymmetric structure seen in the orders received from clients. Therefore, in order to resolve inventory management problems at a cryptoasset marketplace, it is necessary to consider the unique nature of the crytoassets market in order to build an optimal liquidation strategy. To this end, this research defines inventory management problems for cryptoasset marketplaces and proposes an optimal liquidation strategy based on stochastic control. We made estimates of model parameters using data released publicly by cryptoasset marketplaces to obtain an optimal liquidation strategy through numeric calculation. As a result, we show that an asymmetric structure of the frequency of orders from investors in the cryptocurrency marketplace affects the optimal liquidation strategy. In addition, we confirmed the effectiveness of our proposed method by comparing it to simple liquidation strategies.

Future Outlook

The optimal liquidation strategy distilled by this research is one way of resolving inventory management problems at cryptoasset marketplaces. By introducing detailed data from liquidity providers and more sophisticated stochastic models, there is a possibility we will be able to create further profit stability going forward. The results of this research will help to stabilize cryptoasset marketplaces and finally cryptoasset markets overall.